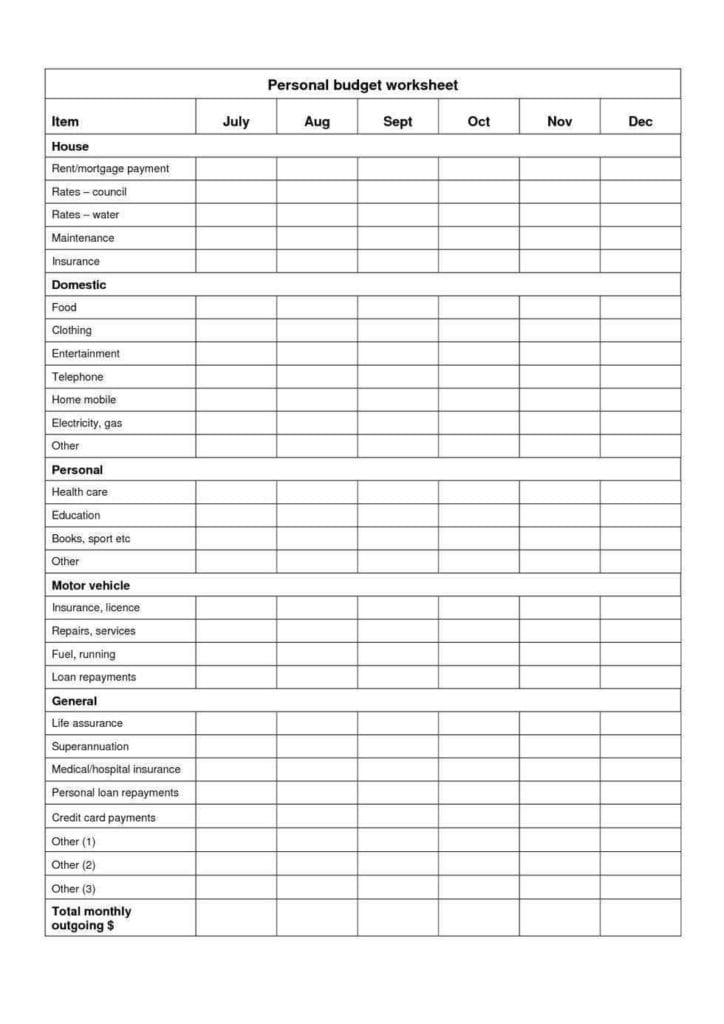

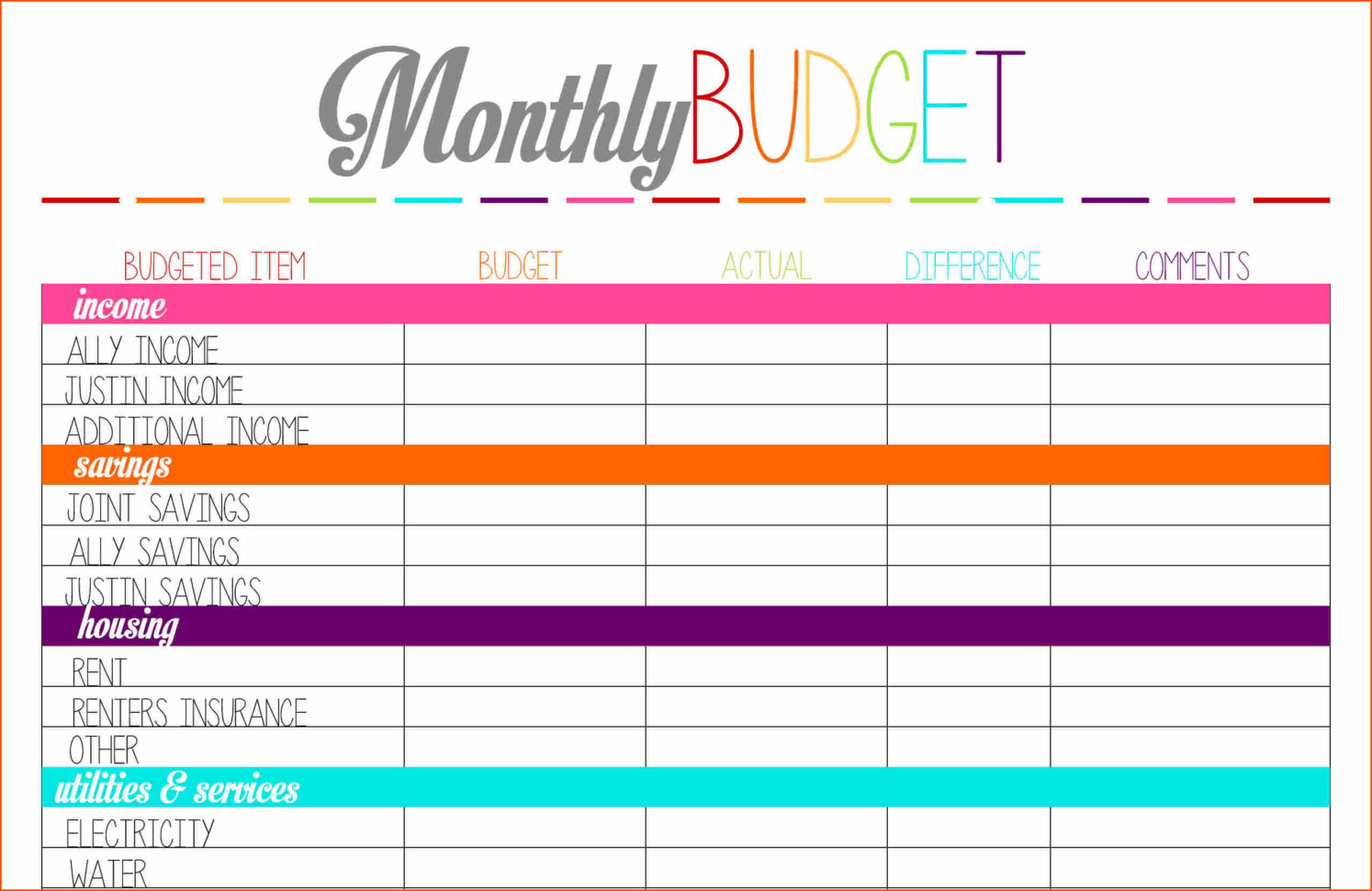

If you don't yet have a high-yield savings account consider opening one, such as Marcus by Goldman Sachs High Yield Online Savings, and earning 16 times more interest than traditional accounts. But you could also use the money on non-essential things like dining out or traveling. Ideally, you'd use this extra money to increase your savings, especially if you don't have an emergency fund. On the other hand, if you have more income leftover after listing your expenses, you can increase certain areas of your budget. It's a good idea to reduce these costs and regularly make adjustments to the amount of money you spend so you can avoid debt. This may include reevaluating how much you spend on groceries, household goods, streaming subscriptions and other flexible costs. You should review your variable expenses to find ways to cut costs in the amount of $300. If you notice that your expenses are higher than your income, you'll need to make some adjustments.įor instance, let's say your expenses cost $300 more than your monthly net pay. The last step in creating a budget is to compare your net income to your monthly expenses. If you find that the average you spend on groceries each month is $433, you may want to round up and set the spending limit to $450. There is space to take note of your income breakdown, savings and debt as well as space to write down any important financial to-dos that you might have You. To calculate the average amount you spend on groceries, for example, add up all of your grocery spending during the past three months and divide by three. But fixed utilities, such as electric and gas, and variable costs, such as dining and household goods, often fluctuate month-to-month, so you'll need to do some math to find the average.įor these categories and any where you spending changes from month-to-month, determine the average monthly cost by looking at three months worth of spending. For example, debt repayment on a mortgage or auto loan will cost the same each month. 41.16 6.47, Get this bundle and save, Save, Description, Plan your personal budget with the personal monthly budget planner template using its simple layout and well-thought-out structure. You can look up your spending on bank and credit card statements.įixed expenses are easier to list on your budget than variable expenses since the cost is generally the same month-to-month. Build a budget to take the first step toward a comprehensive saving and spending.

#Monthly budget planning free

Here is the collection of best printable budget templates broken down by categories (they are 100% FREE and downloadable, but may contain watermarks and uneditable).After you separate fixed and variable expenses, list how much you spend on each expense per month. A smart spending plan can free up money for the things that really matter. But if you like to plan everything with pen and paper, then budget printables will be a perfect solution for you. If you’re 100% digital person, you’re likely to google a smartphone app, excel templates or any other best online budgeting sites. When it comes to tools that can help you achieve that, there are plenty of mediums to choose from. A great advantage of having a budget is a possibility to track your spending habits over time and adjust them accordingly. Use this well-thought-out set of tools and simple layout to get things done easily.

#Monthly budget planning pro

It’s to help you plan for how, what for and how much money will be spent or saved during a particular period of time. Advanced monthly budget planner designed to help you create and manage your budget like a pro effortlessly.

A budget is a structured list of your personal or household expected income and expenses. Whatever you may need money for, it’s important that you stick to your budget day in and day out. You don't want to get a negative balance of your credit card, don't you? Moreover, keeping track of your finances can play an important role in the pace you improve your savings account balance and save money for your dream vacation, house or car. In the world of consumerism, it’s easy to spend a few bucks here and there to suddenly find out that you exceeded your daily, weekly or monthly budget. The ability to manage your cash flow and track your income and expense is vital.

Because it's not only business people who care about profits and expenses. It's no wonder why one of the many tips on personal finance management is to make budget.Īnd you don't have to be a financial specialist to do that. What can be more important than time management? Correct.

0 kommentar(er)

0 kommentar(er)